May 26, 2023 / 07:32

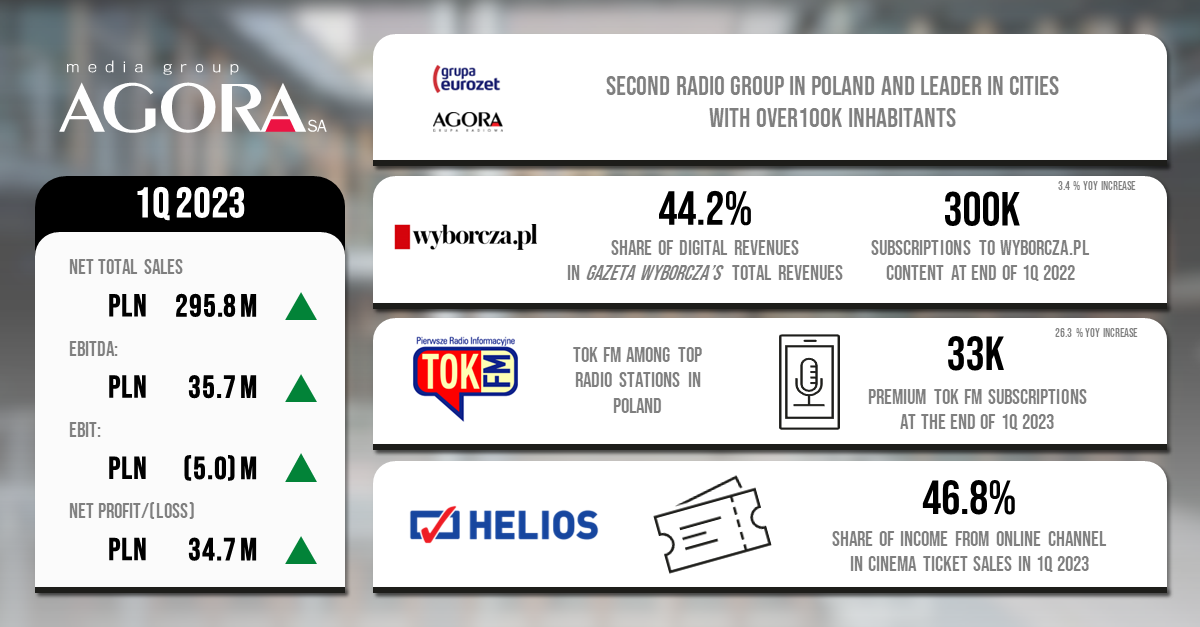

In 1Q2023 the Agora Group recorded revenue growth in almost all its businesses. This was driven in particular by growing advertising sales and Helios cinema inflows, as well as the consolidation with the Eurozet group carried out since March this year. Despite the increase in costs, also resulting from the consolidation and economic conditions, the Group noticeably improved its operating results, doubling its EBITDA profit and at the same time achieving a net profit of almost PLN 35 million. In addition, digital and Internet revenues of the Agora Group reached a record high for the 1Q, which confirms the consistent development of its projects in this area.

– The beginning of 2023 was very good for Agora. We significantly increased our revenues, taking advantage of the beneficial economic situation on the advertising market and cinema attendance. 1Q results also signal the importance of Eurozet's joining the Agora Group, although the full effects of this investment are yet to be seen. We will be able to observe them in the coming months. With a larger and stronger team we are now working on the implementation of Agora's development plans announced a few weeks ago and we are increasingly optimistic about our chances for further growth of the Group's scale and promotion to the podium of the largest media companies in Poland – says Bartosz Hojka, the President of the Management Board of Agora.

In 1Q2023, Agora Group's total revenues amounted to PLN 295.8 million, growing by almost 17% as compared to those recorded a year ago. This was mainly a result of the return of cinemas to full scale operations, as well as the consolidation with the Eurozet group carried out since 1 March this year. The Agora Group observed increase of inflows in almost all categories, especially revenue from cinema operations and advertising sales. Importantly, the Group's digital and Internet incomes increased to a record level for the first quarter - PLN 93.8 million. Over the past four years, these revenues have grown at an average annual rate of almost 12%.

Advertising sales of the Agora Group increased by almost 19% yoy to PLN 124.3 million. The largest contributor to this growth was the increase in radio advertising revenues in the Radio segment, which reached over 88% after the addition of the Eurozet group. Inflows from this category were also higher in the Outdoor segment and in cinemas. In the first case, the increase in advertising sales was mainly due to expenditure on campaigns carried out on citylight, digital, billboard18 and city transport panels, while in the second case it resulted from a full transfer of this business area from the Radio segment to the Film and Book segment, as Helios Media company took over the advertising agency services of the Helios cinema network as of January this year. In the other businesses, revenues from the sale of advertising services were lower. It is worth noting, however, that in the Internet segment this was driven by lower advertising inflows of Yieldbird, with higher ad sales of Gazeta.pl.

According to Agora's estimates, the advertising market in Poland grew by over 5.5% yoy in 1Q2023. Advertisers spent PLN 2.53 billion on promoting their products and services during this period1. This value was also higher compared to the corresponding periods of 2019, 2020 and 2021. Despite this, the company decided not to change its expectations regarding the growth rate of the entire domestic advertising market and its individual segments - Agora's management expects the dynamics of advertising spending in Poland in 2023 to be around 2 - 4%.

Revenues from ticket sales in Helios cinemas increased by more than 31% to PLN 62.0 million, while income from bar sales in cinemas grew by more than 51% to PLN 33.9 million. In 1Q2023, 2.9 million tickets were sold in Helios cinemas - 16% more than last year. On the entire Polish market, the number of tickets sold in the period under discussion amounted to nearly 12.8 million, an increase of over 23% yoy2.

The value of revenues from copy sales amounted to PLN 33.5 million, slightly increasing compared to 1Q2022. This was driven by higher inflows of Agora's publishing business, with a similar level of revenues of the Digital and Printed Press segment as a year ago. However, the revenue structure of the Group's press operations changed - those from Gazeta Wyborcza's digital subscriptions grew, while income from its paper edition declined. The share of digital inflows in the total revenue from sales of Wyborcza amounted to 44.2%, while the share of sales of all digital editions of the Agora Group amounted to 40.3%. It is also worth mentioning that the number of active paid digital subscriptions of Wyborcza reached 300 thou. at the end of March 2023, while the number of sold premium subscriptions of TOK FM increased to over 33 thou.

The Agora Group also recorded an increase in revenues from the catering business due to growing inflows of Step Inside expanding its chain of premises, as well as from other sales, thanks to higher revenues from the sale of printing services and other sales of goods and materials. The only declining category of the Group's revenues was income from film operations - their lower level was due to a high base provided by the high popularity of productions introduced to cinemas in the previous year and revenues from productions for the streaming platform.

The Agora Group's net operating expenses in 1Q2023 increased by over 9% to PLN 300.8 million. They were higher in all businesses except Internet. In addition to general market conditions - including price increases and inflation - the consolidation with the Eurozet group carried out as of 1 March 2023 had a significant impact on the level of the Group's costs3.

Traditionally, the largest item among the Group's expenses were costs of third-party services, while the highest growth rate occurred in the item of costs of consumption of materials and energy and value of goods and materials sold. Staff costs increased in almost all of the Group's operating segments and its supporting divisions. The exceptions to this were the Digital and Printed Press and the Movies and Books segments, where restructuring processes took place in 4Q2022. FTE employment in the Agora Group at the end of March 2023 amounted to 2,579 FTEs and was 223 FTEs higher than in March last year. This increase was mainly due to the inclusion in the Agora Group data of the number of employees in Eurozet group (359 FTEs). The only decrease in the cost area was recorded by the Group in representation and advertising expenditure.

Finally, in 1Q2023 the Agora Group significantly improved its results, achieving an EBITDA profit of PLN 35.7 million, double the previous year's figure, and reducing the EBIT loss to PLN 5.0 million. In addition, the Group generated a net profit of PLN 34.7 million, while net profit attributable to equity holders of the parent amounted to PLN 32.6 million. Net profit was positively impacted by the valuation of Eurozet's shares at the date of taking control of the group in the amount of PLN 47.9 million4.

Apart from the improvement of results, the 1Q2023 also brought two important events for Agora. These were the approval of the Extraordinary General Meeting of Shareholders to spin off companies from Agora S.A. and the acquisition of Eurozet, i.e. the realisation of the next stage of the largest investment in media sector in the Group's history. Thanks to this, the Agora Group is now the 4th largest media group in Poland, after the largest TV stations.

The events at the beginning of this year provided a foundation for the developmental activities of the whole organisation, which will be implemented in line with the strategic directions announced at the end of April by the Agora's Management Board. They are based on the Group's strengths, which are primarily the high quality of content and services offered, an attractive audience and a very broad media reach, as well as advantages related to the development of digital and subscription solutions to date.

The strategic development directions for the Agora Group for the years 2023 - 2026 are: development of media businesses and their reach among audiences in Poland; diversity and autonomy of businesses and opening to external investors; a new management operating model, allowing for standardisation of back-office processes taking into account the independence of businesses; increasing shareholder value and improving financial efficiency of the entire organisation, as well as achieving an EBITDA result above PLN 200 million. As a result, in 2026 the Agora Group wants to be among the TOP3 largest Polish media companies, reaching tens of millions of people with important, attractive content and providing customers with the most effective advertising offer.

While thinking of the implementation of these plans, the company's Management Board is also committed to the development of the entire Agora Group conducted in a sustainable, socially responsible manner. To this end, the Agora Group ESG Strategy for 2023 - 2027 is being developed, the details of which will be presented in the coming days.

Data source: consolidated financial statements of the Agora Group for 1Q2023 according to IFRS.

Footnotes:

1 Advertising market - Agora estimates (press based on Kantar Media and Agora monitoring, radio based on Kantar Media), IGRZ (outdoor advertising), Publicis Media (TV, cinema, internet).

2 Cinema attendance - Helios S.A. estimates based on Boxoffice.pl (cinema) data based on data provided by film copy distributors and based on UIP distributor's film results obtained in multiplex networks.

3 There were no non-recurring events in the 1Q2023, while in the same period last year, the Movies and Books segment recognised an impairment loss of PLN 0.6 million on assets.

4 Excluding the impact of IFRS 16, the Agora Group recorded an EBITDA gain of PLN 10.5 million in 1Q2023. On the same basis, EBIT loss amounted to PLN 11.3 million.

Go back